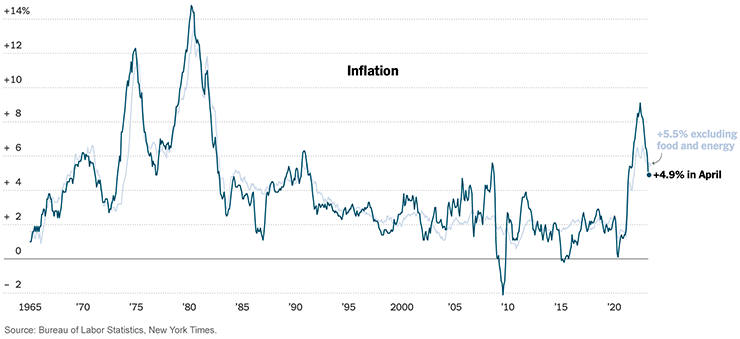

After raising interest rates last year at a clip we haven’t seen since the ‘80s, will Fed officials decide soon that it’s time to take a break?

Though many analysts have been predicting a rate-hike pause may be coming in June, Federal Reserve Chair Jerome Powell said at the FOMC’s post-meeting press conference in May that the committee hasn’t yet decided on its next move. Members will make that determination meeting by meeting, he said, “based on the totality of incoming data and their implications for the outlook for economic activity and inflation.”

That data, so far, has been mixed.

The good news: A government report on consumer prices showed that inflation fell to 4.9% in April, the lowest year-over-year level in two years and less than the 5% economists in a Bloomberg survey expected to see. After excluding food and fuel to get a sense of the underlying trend in price increases (what economists call a core measure), consumer prices climbed 5.5% from a year earlier—a slight drop from the previous reading of 5.6%.

The not-so-great news: Though the CPI reading has gone down considerably since peaking at about 9% in June 2022, we’re still sitting at more than double the Fed’s 2% target for inflation.

What Do Rate Hikes Mean for You?

The Fed’s rate hikes, which are intended to slow down spending, growth and inflation, appear to be working … but it’s going to take a while for the economy to cool.

In Octavia’s 2023 Outlook, we noted that moderating inflation would likely be a key theme this year—and we’re seeing that now. We believe inflation will continue to slow, but it’s likely to be a long, bumpy road. The Fed’s interest rate increases, thus far and going forward, could have both positive and negative effects for your family, depending on which side of the ledger you’re looking at.

- For consumers, it’s been a bit of a roller coaster. Gasoline prices jumped 3% just in April, but grocery prices dropped for a second straight month. Used car prices rose, but new car prices declined. Rental costs continued to rise, but that rise was a bit slower in April. Though recreation and personal care costs were up, airline fares dropped 2.6%, and hotel prices dropped by 3%just in time for late-spring and summer travel.

- For savers, the Fed’s hikes have resulted in the highest yields they’ve seen in many years. Though no one’s going to get rich (or even outpace inflation) by putting all their money in a savings account or CD, there is more incentive to save these days—and that’s a plus.

- For borrowers, on the other hand, rate hikes can be a bane. Credit card interest rates are closely tied to the Fed’s actions, so consumers with revolving debt already may have seen their rates rise by at least a few percentage points. Other types of borrowing aren’t as directly linked to the Fed’s benchmark rate; still if you’re looking for a new car, home or student loan, you’ll probably pay more than you would have a year ago.

- For investors, well, that’s harder to nail down. Certainly, the Fed’s actions have caused some volatility in the stock market—but a rising interest rate environment can have an even greater impact on investors whose portfolios are more exposed to bonds (like those who are in or near retirement). Which is why it’s so important to work with your Octavia wealth advisor to mitigate this risk.

What Factors Will the Fed Consider in Its Decision-Making?

The Fed’s plan to slow the economy with an aggressive series of rate hikes is beginning to show results. Still, policy makers may not be ready to take their foot off the brake pedal just yet.

What factors will Fed officials be watching for as they decide their next move?

FOMC members won’t receive the May consumer price report until June 13, which is just one day before their next meeting. So they’ll likely give the April report a fair amount of consideration when making any policy decisions. They’ll also have the May jobs report, which comes out June 2, to help them gauge how the labor market is doing. (A softening labor market and slowing wage growth is generally seen as necessary to lower inflation.)

We expect the Fed will continue to watch what’s happening in the banking industry, as well, following the unexpected collapse of Silicon Valley Bank and Signature Bank in March, and the sale of Credit Suisse to UBS. FOMC members also will be keeping an eye on services inflation—the price we pay for childcare, health care, personal care, etc.—which historically has been stickier than goods inflation.

The Octavia team will be monitoring these government, industry and news reports, as well, along with each move the Fed makes going forward, and we’ll keep you informed of any developments that might affect your pocketbook or portfolio.

In the meantime, if you have concerns or questions about inflation or interest rates, please feel free to reach out to your Octavia wealth advisor. We’d be happy to discuss the risks and opportunities of this current economic environment.

Federal Reserveinterest ratesAll information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Octavia Wealth Advisors (“Octavia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Octavia and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://octaviawa.com.