It’s not unusual for investors to be nervous about how a U.S. presidential election might affect the overall economy, the financial markets and, more specifically, their own portfolio.

Thanks to a 24/7 news cycle, and a bombardment of mostly negative campaign ads, it may become increasingly difficult to avoid feeling anxious about what will happen in the coming weeks… and the next four years.

But here’s the thing: Historically, election outcomes have not had a lasting effect on the markets.

We could potentially see a market rally or pullback that’s linked to the election campaign or the aftermath of the vote, but other factors may have a stronger influence on the markets than who ends up in the Oval Office.

With that in mind, here are five takeaways to consider as we make our way through the pre- and post-election uncertainty that’s ahead:

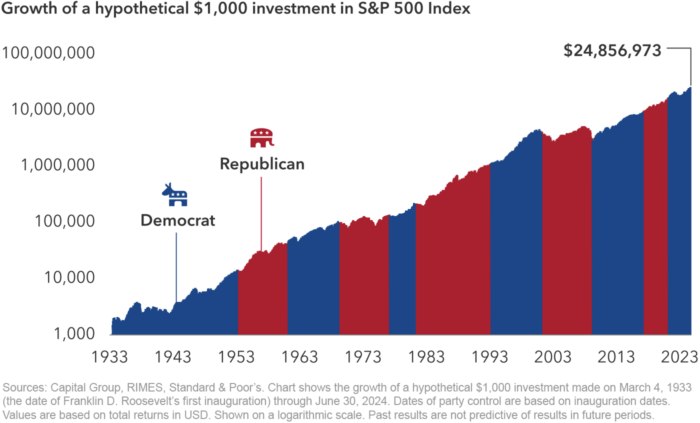

- The U.S. Financial Markets Are Nonpartisan: You might have heard that having one political party in power tends to lead to better market returns than the other. But the data just doesn’t back that up. As seen below, for almost a century, the S&P 500 has averaged positive returns under nearly every combination of partisan power—regardless of which party was in the White House, or had the majority in the Senate or House. Some years saw better performance than others, but market fluctuations are often driven by factors like corporate earnings, economic indicators, monetary policy, or global events, rather than the policies of the current party in charge.

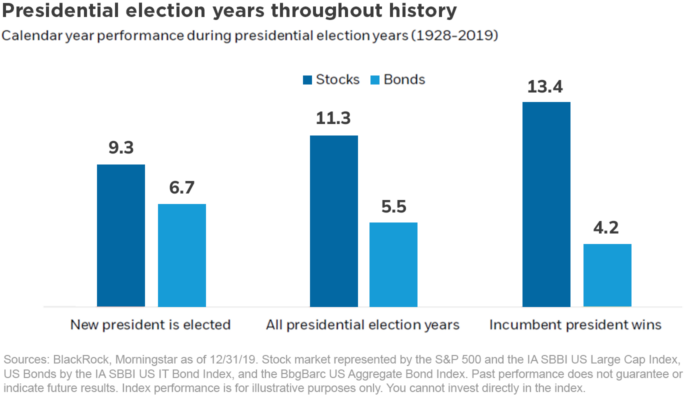

- Election Year Uncertainty Isn’t as Consequential to Your Portfolio as You Might Think: Yes, we’ve all heard the saying that the stock market hates uncertainty. But based on the chart below illustrating S&P 500 performance between 1928-2019, the average annual returns for all presidential election years is 11.3%. The S&P 500 has historically performed better when an incumbent wins re-election—and what that might mean in this unusual election year is hard to say. What we do know is that over the long run, the market as a whole has trended higher. Past performance is not a guarantee of future results, of course. But going back almost 100 years, the S&P 500 has gained an average annual return of about 10% a year. In that time, 17 different people have held the office of president.

- Trying to Predict Policy Impacts Is Risky Business: Do the words “within the margin of error” make you wince every time a new election poll comes out? The 2024 presidential race is so close that no one can predict who will win, let alone which policy proposals will be implemented, or which stocks or sectors—like energy, technology, or health care—will benefit if they do. Investing based on a candidate’s campaign promises is a little like making investment decisions based on something you overheard at a neighbor’s barbecue.

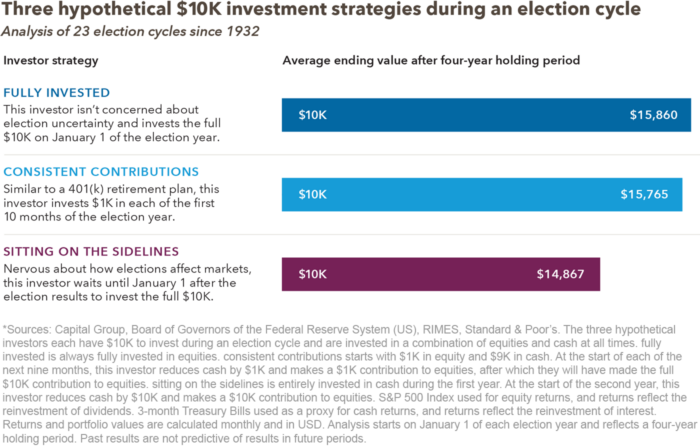

- Cashing Out and Sitting on the Sidelines Can Also Be a Bad Idea: It may be tempting to move some money to cash for safety until the election kerfuffle is over. The trick is knowing just when to get out and when to get back in. Rallies can potentially occur after a pullback (and vice versa)—and the volatility seen during an election period might not be due to the election itself. Investors who try to time the market during an election cycle, instead of staying the course, may find that it’s a losing strategy in the long-term, as highlighted below.

- Economic Fundamentals Are What Really Matter to Market Performance: Factors such as inflation, consumer confidence, employment, and GDP have consistently shown to be more influential on the markets than who’s in the White House. That doesn’t mean the market won’t react to something that happens during the run-up to the election, or in its aftermath. But knowing what’s in your portfolio and the purpose behind your various investments can help you tune out the noise and stick to your long-term plan. If you’re feeling anxious about the election or changes that could have an impact on your portfolio, this may be a good time to check in with your financial advisor.

In summary, a look back at the historical data tells us that a presidential election is unlikely to significantly impact the markets, either positively or negatively. But if you have concerns, it might be beneficial to review your portfolio with your advisor to make sure you have a diversified mix of asset classes that aligns with your goals, timeline, and risk tolerance.

At Octavia Wealth Advisors, we always want our clients to feel confident about their investments and in control of their financial future. Reach out to us today. We’re ready to answer your questions and help create a financial plan that’s personalized to your needs.

electionInvestingstock marketSources: Fidelity, Forbes, Kiplinger, Morningstar, Money, The Economist, The Wall Street Journal, Investopedia, Baird Wealth Management.

*The forecasted performance shown was created by Capital Group by using assumptions generated from the data sources referenced. The forecasted performance does not reflect actual trading and does not reflect the impact that material economic and market factors may have had on Octavia Wealth Advisors, LLC’s decision-making. The results shown were achieved by means of a mathematical formula. The forecasted performance shown is not indicative of actual future performance, which could differ substantially.

Views and opinions are subject to change at any time based on market and other conditions. It is not intended to offer or deliver personalized investment advice in any way, which would only occur with the formal execution of an investment services agreement with Octavia Wealth Advisors, LLC. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Octavia Wealth Advisors (“Octavia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Octavia and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://octaviawa.com.