If you’re wondering how much higher the S&P 500 might go this year, you’re not alone. Despite some ups and downs, the index is up about 10% year to date. Which probably has many investors asking, “What recession? If the S&P 500 is having such a great year, doesn’t that mean most U.S. companies are doing well?”

Though it’s one of the most widely quoted indexes, many investors often don’t understand how the S&P 500 works—or what the numbers they hear reported every day actually represent. The truth is that although the S&P 500 is up overall in 2023, more than half of the companies listed on the benchmark index are in negative territory year to date.

The S&P’s attractive historical average annualized return of 9.82% (1928 through 2022) highlights its long-term growth potential. And we believe this popular index can serve an important role in many investors’ portfolios. But if you’re thinking of putting all or a significant portion of your money into the S&P, it’s important to understand how you’re invested and the underlying risk. Here’s why:

- The S&P 500 Isn’t as Diversified as You Might Think. Because the S&P 500 consists of stocks that span several different sectors and industries, investors often feel they’re getting the diversification they need to protect their portfolio. But remember, the S&P includes only large companies—and they’re all in the United States. If the U.S. were to experience an economic downturn, you could be looking at a substantial loss. Without other types of investments to offer ballast, you might be putting your whole retirement nest egg at risk.

- The Way the Index Is Weighted Can Also Be Problematic. Because the S&P is weighted by market capitalization (the total market value of all outstanding shares of a company’s stock), its largest stocks can have a major influence on its performance. For example, so far this year, most of the index’s gains have been driven by a small number of mostly tech stocks, including Apple, Microsoft, Amazon, Meta and Alphabet. In fact, the top 5 stocks in the S&P 500 currently account for about 25% of the index. If those stocks falter, investors in the index could suffer.

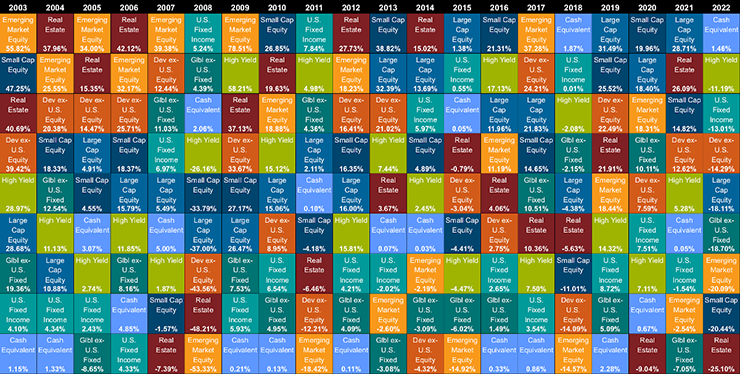

- You Could Miss Out on Other Opportunities. Besides risking a loss because you’re only invested in the S&P 500’s large-cap U.S. stocks, there’s also the chance you could miss out on potential gains in other asset classes. As the table below shows, the top-performing sector or asset class typically changes from year to year. Sometimes, it’s real estate or small caps. Or it could be emerging market equities, fixed-income products, or even cash equivalents.

Annual Returns for Key Indices Ranked in Order of Performance (2003-2022)

Click to view full size

Source: Callan Periodic Table of Investment Returns.

Unfortunately, we can’t predict when those categories might change. That is why we recommend truly diversifying your portfolio, with investments that can help minimize risk and volatility but also have the potential to reap attractive returns. Depending on your individual goals and risk tolerance, these might include a mix of U.S. stocks and bonds, but also international investments and alternative investments, such as private equity opportunities, private credit structured notes, or real estate investment trusts (REITs).

Given the recent market appreciation of these few stocks in the S&P 500, now may be a good time to consider reallocating a portion of your portfolio into less appreciated investments that have more focus on long-term value, rather than short-term growth.

Building a Diversified Portfolio

Investors are trained to focus on accumulating as much money as they can for retirement; and that can be a good thing when you’re young and just starting to invest. But regardless of your time horizon, a diversified portfolio—allocating money across many asset classes, geographical regions, sizes and sectors—is the foundation of any smart investment strategy. As you near retirement, it becomes especially critical for wealth accumulation to cede the spotlight to wealth preservation, but diversification is always important.

There may be times when your diversified portfolio might overperform the S&P 500 and underperform at others. But the goal of a diversified portfolio isn’t to match or outperform the S&P. The goal is to maximize the risk-return relationship and protect your nest egg.

If you have concerns or questions about your portfolio, please feel free to reach out to your Octavia wealth advisor. We’d be happy to discuss how the right mix can help you make the most of market opportunities while also aiming to mitigate risk.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Octavia Wealth Advisors (“Octavia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Octavia and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://octaviawa.com.