If, like most investors, you’re feeling a bit rattled by the market’s recent ups and downs, you may want to take a few deep breaths. It looks as though the road ahead could be just as bumpy.

We started 2022 with an eye on several risk factors we expected to influence the market—from rising inflation (and what that might mean for Fed policy and interest rates) to the continuing unpredictability of the Covid pandemic.

Now, nearly midway through the year, those factors are still a focus, but we’ve added a few other things to the watch list, including the ongoing war in Ukraine and the upcoming midterm elections.

It may feel as if the financial news is on a negative loop, and investors might find it difficult to remain calm and stay the course. But this is not the time to make drastic changes to your portfolio. If you’re seeking to grow your wealth over the long term—as most investors are—you should know that volatility is a normal part of the market cycle, and your Octavia portfolio is built with this in mind.

Current and Potential Market Drivers

So, where are we now and where are we headed? Here’s an update on some of the issues you’re likely to hear or read about in the second half of 2022.

- Russia’s Invasion of Ukraine: Despite being hit with a raft of export controls and financial sanctions, there’s no sign that Russian President Putin plans to relent in his efforts to reverse Ukrainian independence. Supplies of Russian oil, gas, metals, wheat and corn already have been significantly reduced, sharply driving up prices globally. As the war rages on, continued uncertainty could dampen consumer confidence—more so abroad, but also in the U.S.

- Rising Interest Rates: The Fed raised its benchmark interest rate by three-quarters of a percentage point last week—the largest rate hike since 1994—and the Federal Open Market Committee (FOMC) has signaled more rate increases to come. Futures markets are currently pricing in as many as 10 hikes this year, with a potential rate of 3.0% to 3.25% by December. That isn’t necessarily all bad, as rising rates affect different investments in different ways.

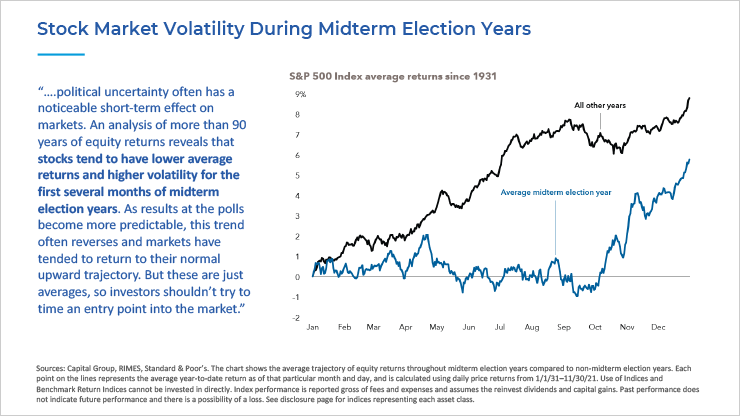

- Midterm Elections: The stock market doesn’t like uncertainty, and volatility tends to be higher just before and after midterm elections. But the historical data below also show the markets typically bounce back higher in the two quarters after midterms occur—which generally means long-term investors can wait for the dust to settle. That said, no one can predict the future of politics or the market with any real certainty ever … and this year looks particularly baffling.

- Covid Pandemic: Covid created a global health and economic crisis—and it’s far from over. While many Western nations have largely reopened their economies, China’s commitment to a “zero Covid” policy led to several major lockdowns in recent weeks, halting factory production and further stressing global supply chains. Though restrictions seem to be easing in Shanghai and Beijing, which is good news, the U.S. and global markets likely will continue to react strongly to every twist and turn as we attempt to transition to some sense of “normal.”

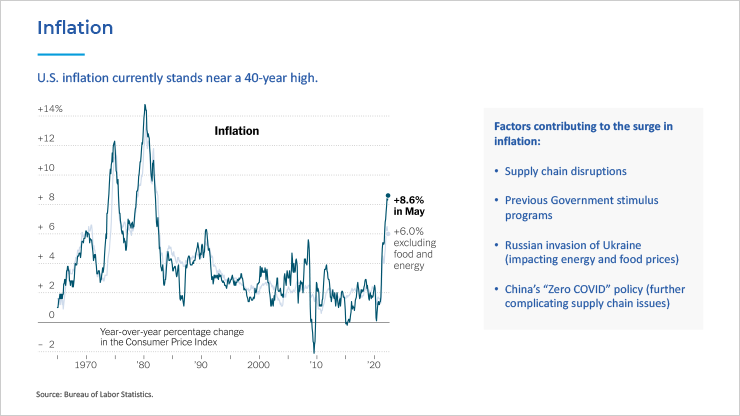

- Persistent Inflation: Just like COVID, inflation doesn’t appear to be going away any time soon. As the following chart shows, U.S. inflation is at a high we haven’t seen in decades. However, inflation risk is something everyone should always be aware of—especially retirees living on a fixed income, but also investors with a longer time horizon. Though stocks can provide a hedge against rising prices over the long term, uncertainty about the Fed’s reaction to stubborn inflation could result in elevated market volatility in the short term. Buckle up, but bear in mind: All of this—the Fed’s response and nervousness about the Fed’s response—is normal.

What Does This Mean for You?

Anyone who’s ever traded a beloved sports car or motorcycle for a more sensible “family” ride knows how this goes.

It’s not as fun to drive the slower vehicle on the open highway, and you probably don’t brag much about the new car’s safety features at neighborhood barbecues. But at the end of the day, that boring ride is far better equipped to deliver you safely to your destination.

History shows that staying invested with a diversified portfolio (one that’s designed around your individual time horizon, risk tolerance, needs and goals) can be key to long-term investing success.

Sticking with a carefully chosen and stress-tested asset allocation can help capture the upside of the markets (as stocks generally rise over long stretches), and still protect against the downside (as some investments may decline over shorter periods). At Octavia, we will continue to strategically position your portfolio to meet your personal investment goals over many years.

For those with a shorter time horizon, including retirees or those who rely on their portfolio for income, some changes may be warranted to mitigate volatility and preserve your wealth. Please contact your Octavia wealth advisor if you believe this situation applies to you.

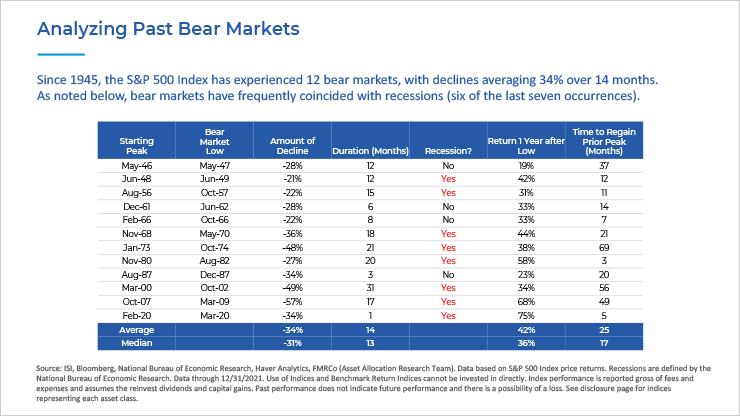

If you have a longer timeline, you still may want to talk to your advisor about rebalancing your holdings while keeping your long-term goals in mind. The table below shows how difficult it can be to predict how long a downturn or bear market can last—or how quickly certain investments might rebound. During volatile markets, asset diversification can shift, and rebalancing is a cautious approach to managing risk and keeping investments aligned.

Finally, even if the broader market continues to struggle for a while, there may be new investment opportunities to explore as we move forward. We’ll remain vigilant as the economy transitions through the next few months, and we’ll update you on these possibilities as they arise.

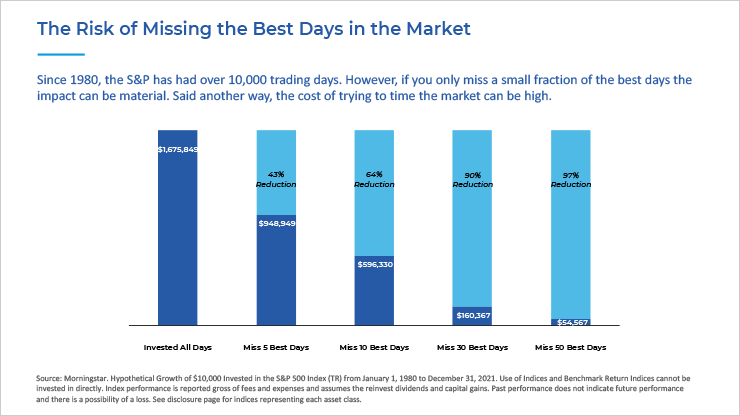

In the meantime, we recommend filtering out some of the financial media noise when you can. Trying to “time” the market can be counterproductive and can often do more harm than good, and you may end up missing the best days in the market. Preparation is the more strategic way to go, and your Octavia financial plan is designed to mitigate the inevitable ups and downs.

Of course, any time you have questions or would like to discuss your portfolio, please feel free to reach out to your Octavia wealth advisor. We want to help you navigate the turbulence and make your financial journey as smooth as possible.

market volatilitystock marketAll information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Octavia Wealth Advisors (“Octavia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Octavia and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://octaviawa.com.