2020 has had no shortage of challenges. We’re all navigating this moment the best we can, and many are wondering how these times will affect their investments. With the election just around the corner, we could be in for some short-term market volatility. During times of uncertainty, it can be tempting to make one of two mistakes:

- Pulling your positions and going to cash. Research shows us that those who try to time the market almost always underperform, netting less in overall returns when compared to those who stay invested over the long term.

- Keeping your head in the sand and doing nothing. On the other side of the spectrum, ignoring market volatility entirely is hardly a sound investing plan. If left unchecked, your portfolio’s asset allocation could drift into dangerous territory, which could impact your returns.

The best path forward is staying invested while making some reasonable tweaks to your portfolio. This is where rebalancing comes in. When done right, it’s a strategy that can provide a cushion against volatility and improve your potential for long-term returns.

First, let’s take a closer look at what impact the election could have on your portfolio.

How the Election May Affect Your Investments

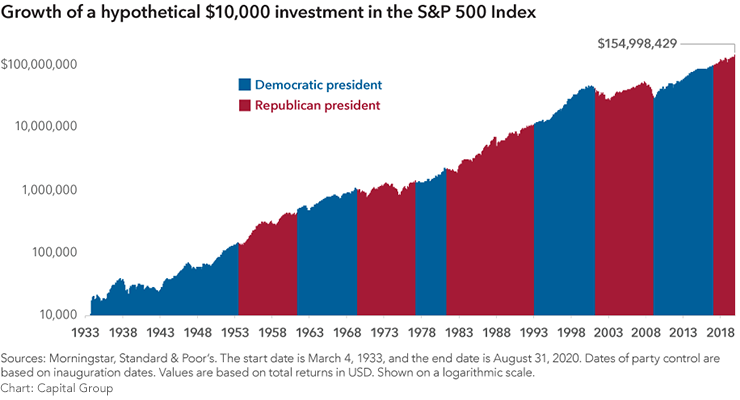

While it’s easy to get swept up in all the drama this election year has sparked, it’s also important to remember that previous election outcomes have never had any lasting effect on the markets. For close to a century, the market has moved in an upward direction—even in the face of hotly contested elections.

It wouldn’t be out of the ordinary, however, to experience volatility in the short term—especially if the election is contested. With that said, history shows us that this type of short-lived disruption tends to pass.

What Does It Mean to Rebalance My Portfolio?

Your investment portfolio is meant to reflect a mix of asset classes (e.g. stocks, bonds, and cash) that is appropriate for your goals, timeline, and risk tolerance. As time goes on, assets naturally move and change due to regular market activity. And if there’s a big shake-up—like a pandemic—your asset allocation could be thrown off course within a relatively short time period. For example, a conservative portfolio that started out with 60% bonds/40% stocks could wind up 50% bonds/50% stocks. This could indirectly increase risk and make you more vulnerable to future market swings.

Rebalancing your portfolio is a simple act that can help mitigate long-term risk. Think of it as a tune-up that resets your portfolio back to your target asset allocation. This involves offloading overweighted assets by selling stocks when prices are high, or buying stocks when prices are low. Either way, the objective is to restore balance and get to an allocation that’s aligned with your individual goals and risk tolerance.

A good rule of thumb is to rebalance your portfolio annually, but it’s also wise to check in with your financial advisor during times of increased uncertainty or volatility.

The Importance of Diversification

Rebalancing your portfolio can also help keep your investments diversified. A healthy portfolio is one that reflects a variety of different sectors, like consumer staples, health care, tech, and so forth. It’s smart to invest in domestic and foreign companies as well. This way, if one sector or economy gets hit unexpectedly hard, you’ve already spread out your risk—and your portfolio can more easily absorb the loss. It’s also smart to think in terms of market capitalization. This can anchor your portfolio in large-cap companies while still benefitting from the potential growth of small- to -mid-cap companies. If your portfolio isn’t as diverse as it could be, you’re especially vulnerable to volatility. Rebalancing can adjust discrepancies among different assets and sectors, making for a more robust and even-keeled allocation.

Why Now May Be a Good Time to Rebalance

Given the uncertainty of the moment, along with the upcoming presidential election, now might be a particularly good time to rebalance your portfolio—especially if you haven’t done so in a while. This year has brought its fair share of market volatility. Connecting with your financial advisor to check in on your portfolio could be a great proactive step in protecting your investments. They may recommend rebalancing your portfolio to put you in the best position for long-term returns.

During periods of market volatility, it may be tempting to make big moves by trying to time the market. Alternatively, you may be inclined to just look the other way and do nothing. Rebalancing is ideal because you’re taking deliberate, strategic action that’s driven by your long-term financial goals. At Octavia Wealth Advisors, we’re here to help our clients manage their investment portfolios in a way that makes them feel confident and in control. Reach out to us today so we can answer your specific questions and create an action plan together.

diversificationelectionrebalancingAll information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Octavia Wealth Advisors (“Octavia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Octavia and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://octaviawa.com.